You want to save $10000 in a year and this post is for you. Let me share some of the simplest ways I save $10,000+ every year, and how you can too – lazily.

Why do I call them lazy tips? Because once you take out an hour and set everything up, you’re done.

How you can save $10000 this year

Middle-class folks get in the way of their money. They don’t let it flow to the right places.

And you, my friend, who’s planning to go beyond the middle class to get your savings to $10,000+….

You are preparing to be in the top 21% of the population.

So, how can you make this transition? At present, you have two things certain:

- Your salary is credited to your bank weekly or monthly

- Your earnings are either consistent or growing at a very slow pace

Based on these two assumptions, let’s get right into the simplest ways you can save your net worth goal this year.

1. Do a simple budget (boringggggg)

Budgeting is boring. But you need it to start off.

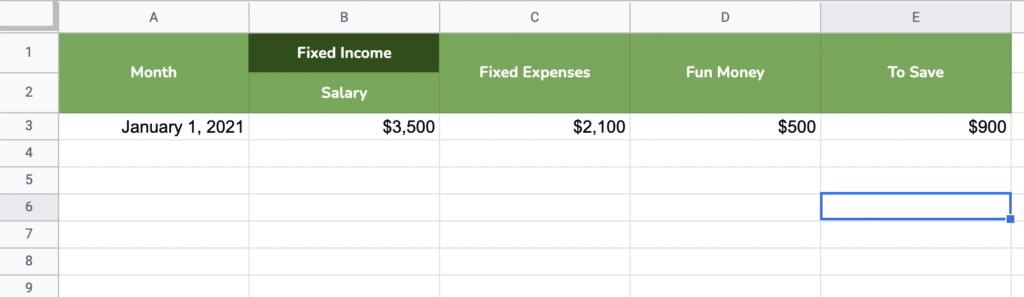

So, let’s not go overboard. We only need to add 3 things

- What’s your FIXED monthly income?

- What are your FIXED monthly expenses (food, rent, bills) – Add them up and write a single number

- How much of the remaining amount will you keep as fun money?

At the end, you should have a simple notes file or an excel sheet like the one below:

Your are bound to have different numbers in these columns. But it doesn’t matter.

What we’re looking at is only the “To Save” column.

Try and get it to be as high as possible for your current situation and then move to the next step.

2. Find at least two places to save $10000

I’m quite the conservative person with my money. And you may be okay with higher or lower risks.

But for saving your first $10,000 I’d suggest you start with conservative options.

Knowing how much risk you are okay with tells where you should invest. For starters, the best options are:

- 401k

- Roth IRA

- Debt funds

- Index ETFs

With the Roth IRA, you can invest a maximum of $6,000 per year below the age of 70 and $7,000 per year for people over 70. This comes up to a maximum monthly investment of $500.

For a 401k account, you can invest upto $19,000 per month which is $1,583 a month. The major benefit with a 401k investment is that your employer may match your contribution giving you double the savings! This can be a much faster route to save $10000 within a year if you can get your employer to match.

Debt funds can be considered once you’ve maxed out your 401k accounts. Index ETFs are good for longer term and I cannot go without saying that they’re really great investment instruments nonetheless.

In my opinion, start out with a 401k and the Roth IRA.

3. Call the bank to setup a standing order/standing instructions

This is the part where you’re going hands-off.

After you’ve finalized on where you want to invest, it’s time to setup standing orders/standing instructions.

With a standing order, the amount you specify is automatically transferred to an account you choose at the date you specify.

What you need your bank to do is to automatically transfer the amount that we calculated in #1 to the investment vehicles that you chose in #2.

Recommended read: How many bank accounts should I have?

If you have enough in your to-save section, you can be well on your way to save $10000 within a year.

Flowing money is growing money.

And you’re getting out of the way of your money from flowing.

4. Save leftover fun money to speed up your $10000 savings goal

Remember the fun money that we calculated in #2?

Yep, we’re not letting it go waste.

Let’s say you have $500 as fun money and you end up spending only $200 in a month.

The remaining $300 goes straight to your investment accounts. You don’t carry it forward to the next month.

At the end of the month, any amount that is left over in your bank, should go straight to your investment accounts.

Now you can do it manually, or check with your bank if they can make this happen for you at the end of the month automatically. I prefer the automatic way so you don’t end up “keeping” the money for yourself.

5. Add any additional amount to speed up your savings goal

This step is a little harder but you’ll be well on your way to save $10000 very quickly if you add additional money to your savings every month.

This can be done using apps like iBotta that offer cash rewards for shopping, using high-interest savings accounts where any interest is saved, and going out less often until you save the $10,000 within this year.

Enjoy your first milestone!

Within a year, you will have already hit your savings goal of $10,000. And even if you haven’t, don’t put yourself down.

You will be much closer to your goal than in the previous year.

With this same automated savings formula, you’ll no longer have to worry about manually saving money ever again.

I hope you enjoyed reading about the different ways to save $10,000 in a year. Continue to follow the site if you need more tips.